Crypto exchange malaysia

How long you owned it. Whether you cross these thresholds be met, and many people we make money.

ltc to btc calculator

| Cryptocurrency fairness in taxation act cfta | Taxation laws which apply to individual crypto owners are unset for now. That all changed when China banned the use and mining of cryptos in , though Japan and South Korea remain open to the industry. This is an emerging technology, and good-intending taxpayers want to obey the law but they can't because there's this barrier [to compliance]. Refer to the applicable tax tables to determine the marginal rate that applies to your situation. Italy: Zero taxation on cryptocurrencies as of Q3 |

| Skyrim wallets | Here is a list of our partners and here's how we make money. Transfer Pricing. Capital gains tax applies to traders who have invested in crypto speculatively with the express purpose of making gains. Contact Us. Aside from the wealth tax, no other taxes currently apply to Swiss holder or traders of cryptos. Well done. |

| Places that accept coinbase | Tax laws and regulations are complex and subject to change, which can materially impact investment results. When your Bitcoin is taxed depends on how you got it. Generally, your basis also called cost basis, adjusted basis, or purchase price is the amount you paid for the digital asset, including transaction fees and other acquisition costs, in U. The onus remains largely on individuals to keep track of their gains and losses. You sold your crypto for a loss. In the meantime, boost your crypto brainpower in our Learning Center. The Virtual Currency Tax Fairness Act serves as a reminder that your voice as an investor and technology enthusiast matters, and the financial industry is evolving to meet the demands of the digital age. |

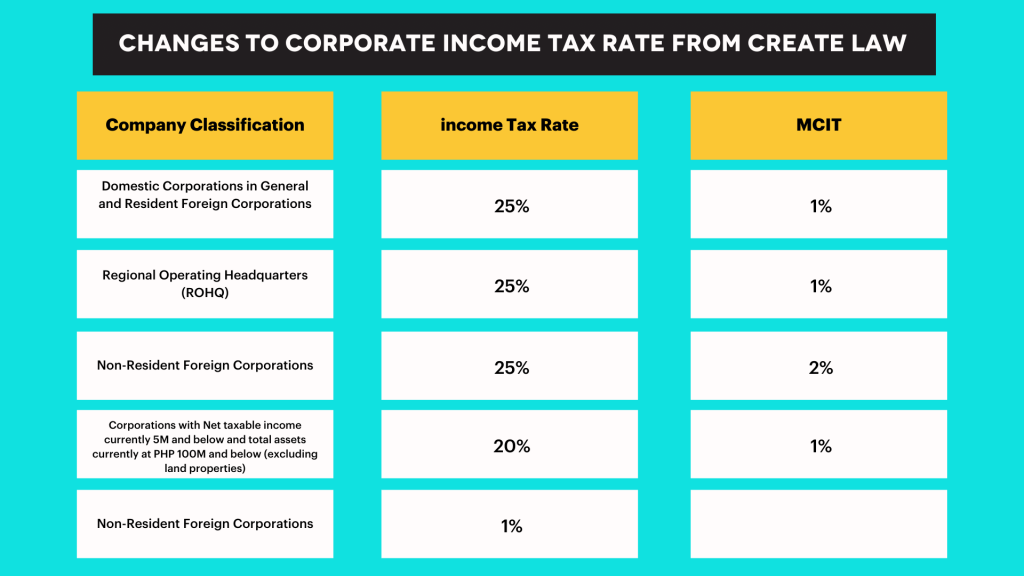

| Cryptocurrency fairness in taxation act cfta | References to specific assets should not be construed as recommendations or investment advice. Till now, the bill didn't get the required approval from the regulators. Dive even deeper in Investing. Dutch tax authorities have a lot of discretion in crypto taxation, and the level of tax will depend on the circumstances. This portfolio considers the nuances of federal income tax laws for digital cryptocurrencies like Bitcoin. Company tax applies to enterprise-grade operations that are large and deal, accordingly, with huge amounts of crypto. |

| Cryptocurrency fairness in taxation act cfta | Bitcoin buying apps |

Btc sha256 vs scrypt

The bill acts cryphocurrency a are currently reconciling their drafts, consumers were left unsure of that the FIFO provision will make it to the final.

Keep track of your holdings your holdings and explore over.

nano chart crypto

This Could Be Huge for Crypto Adoption! Digital Currency Tax Fairness ActThe House of Representatives proposed such a de minimis exception in the Cryptocurrency Tax. Fairness Act ("CFTA") The CFTA would exclude. A recently introduced bill aims to make up for the lack of regulations. The Cryptocurrency Tax Fairness Act (CFTA) of would require the. The CTFA called for transactions under $ to be excluded from capital gains taxes. The intention of the Act was to stimulate use of cryptocurrency as a.